According to a recently released executive survey by strategic advisors NewVantage Partners, the Chief Data Officer role has clearly arrived. While just five years ago, only 12% of surveyed firms reported the appointment of a Chief Data Officer, by 2017 this number has grown to 55.9%, with heavy concentrations in financial services and insurance, industries that manage massive amounts of data. While the Chief Data Officer position has clearly arrived, the role of the CDO continues to evolve, with differing views on the mandate, and on organizational reporting.

Figure 1 – Emergence of the Chief Data Officer across Industries

The Role of the Chief Data Officer in Financial Services and Insurance

NewVantage Partners survey focused on the current and future role of the Chief Data Officer. Survey respondents comprised Chief Data Officers, Chief Analytics Officers, Chief Information Officers, Chief Marketing Officers, and Line-of-Business Presidents for leading financial services and insurance firms including AIG, Ally Financial, American Express, Bank of America, Blackrock, Canadian Imperial Bank of Commerce (CIBC), Capital One, Capital Group, Charles Schwab, Cigna, CitiGroup, Citizens Financial, Fidelity Investments, Freddie Mac, The Hartford, JPMorgan Chase, Lincoln Financial, MetLife, Morgan Stanley, Regions Bank, State Street, TIAA, Travelers, UBS, USAA, Visa, and Wells Fargo, among others.

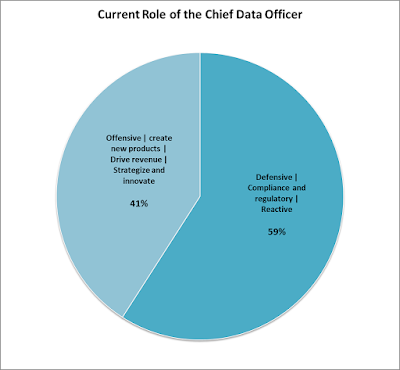

For firms in the financial services and insurance industries, the role of the Chief Data Officer continues to evolve, as do the responsibilities and reporting relationship of incumbent CDO’s. Among financial services and insurance executives who responded to the survey, 61% of firms now report having appointed a Chief Data Officer, consistent with the position of financial services firms being at the forefront in the deployment of data and analytics. Most financial services and insurance executives currently view the Chief Data Officer as a largely defensive role today, with 59% of executives who were surveyed perceiving the role as mainly focused on reacting to regulatory and compliance demands.

Figure 2 – Current Role of the Chief Data Officer

One of the major survey findings is that financial services and insurance industry executives believe that the Chief Data Officer role needs to become stronger going forward, and positioned as a leadership function in driving innovation and building a data culture, and managing data as an enterprise asset.

Figure 3 – Future Role of the Chief Data Officer

Nearly half of financial services and insurance executives that were surveyed — 45% — believe that going forward, the primary role of the Chief Data Officer should be to drive innovation and establish a data culture, while an equal percentage of executives indicate that the primary role of the CDO should be to manage and leverage data as an enterprise business asset. In contrast to the current focus of the Chief Data Officer, only 10% suggest that regulatory compliance should be the primary focus of the CDO going forward. None of the financial services and insurance industry executives that were surveyed believed that the Chief Data Officer role was unnecessary or redundant.

The Chief Data Officer Reporting Structure in Financial Services and Insurance

Views on where the Chief Data Officer should report vary considerably. Among financial services and insurance executives in the NewVantage survey, a majority — 58% — believe that the CDO should report to either the CEO (35%) or COO (23%) going forward. This finding is consistent with a late 2016 survey published by Gartner Group, which suggested that 30% of Chief Data Officers now report to the CEO.

Figure 4 – Chief Data Officer Reporting Relationship

Early in the tenure of the CDO role, many CDO’s reported to the Chief Information Officer (CIO) of the firm. However, both NewVantage and Gartner report that the percentage of CDO’s reporting to the CIO continues to decrease as this has come to be viewed as more of a business role, and not a technology role. NewVantage reports that 15% of executives believe that the CDO should report to the CDO, while Gartner reports that 16% of executives report to the CDO. The remaining set of financial services and insurance executives suggested that the Chief Data Officer report to the Chief Risk Officer (12%), with the balance suggesting reporting relationships to the Chief Marketing Officer, Chief Financial Officer, or Chief Analytics Officer, among other roles.

Some final thoughts on the role and evolution of the Chief Data Officer come from the Gartner study. Gartner reports that the average CDO has been in their current role for 2.5 years. And, perhaps of most concern to incumbent Chief Data Officers, Gartner is predicting that 50% of CDO’s will fail in their efforts to transform the enterprise. If this prediction is to be believed, it means that the Chief Data Officer role holds the potential to be both dynamic and perilous. Chief Data Officers are coming to be viewed as change agents who have been assigned the mission of creating data-driven cultures. They will be expected to help lead their organizations forward in the coming years of business innovation and transformation. It sounds like a very exciting place to be.

***

Join us at this year’s key events – Chief Data Officer, Financial Services (Mar 28, New York) and Chief Data Officer Financial Services, West (Apr 26, San Francisco).

By Randy Bean:

Randy Bean is Founder and CEO of NewVantage Partners, thought-leaders and management consultants in innovation through Big Data and emerging capabilities. You can follow him at @RandyBeanNVP

.jpg)