Ahead of Chief Data & Analytics Officer, Europe, held in Frankfurt later this year, one of our 30 expert speaker strong line up Norman Stuertz, CDO, Credit Suisse, wanted to share his thoughts on the ever emerging 'C"suite role.

The Chief Data Officer (CDO) is still a relatively new role, even though the first mentioning of the role goes back more than ten years. Yet in most enterprises who have established this role nowadays, it is on average not older than 3 years. As I found out in talks the role is sometimes still not known or understood, so I thought this maybe a good reason to sketch a comprehensive overview in three parts: The origins of the role, the current responsibilities with a special focus on banks and an outlook into the near term future.

The drivers of the CDO role (Why do we need one?)

Previously, meaning 2010 and earlier, the topic of using corporate data was usually limited in most industries to management information systems focusing on structured financial, distribution or risk data.

With the technical developments in data storage as well as growth of data in social media, manufacturing and the Internet of Things (IoT), organizations had in the last 10 years access to massive and ever growing amounts of structured and unstructured data. Hence, what was once an overseeable segment of company data, now potentially comprises all of an enterprises data, combined with external data, from structured to unstructured.

Further, advanced analytical technologies since some years offer massive computing power (think of the HADOOP technology stack) and with that the opportunity to provide or convert this data into valuable information to gain competitive advantage.

Mastering these new challenges in terms of data management and big data capabilities offers the potential to outperform competitors by the means of data-driven business innovation. In fact a cross industry research (McKinsey) estimated the potential of a broad usage of data analytics as of up to 10% in sales and 20% savings potential in capital expenditures.

Massive growth of data, internal and external, provides the strategic opportunity to gain competitive advantage

The degree to which organizations succeed in unleashing this potential depends on how they tackle the data assets are managed and eventually leveraged. As like for other corporate capabilities, a specific accountability helps to do that as data is “everywhere” in a company.

This is where the role of the CDO kicks in. It is this emerging, larger managerial field of legacy systems and complex organizational structures, a multitude of data households require growing managerial attention and accountability. Therefore, many organizations have recently appointed a Chief Data Officer (CDO), a relatively new executive role to implement an organization wide data management, for providing data governance and driving data-driven innovation forward. In fact, Gartner expects that 90% of large organizations will have a CDO by 2019 (Forni 2017).

So the reason for the CDO to be there is to play a strategic role in helping to adapt, leverage and transform the enterprise and the external data ecosystems. This as a response to rapid technology innovation and a dire need for digitalization, where the use of consistent, quality data is key for advanced analytics, robotics, cognitive learning and automation.

The importance has also been recognized and confirmed within the banking industry in the past 2-3 years. For example, in June 2016 a first Chief Data Officer Forum was held in NY. Among the participating firms were Bank of America, Bank of China, Capital One, CitiGroup, JP Morgan, Morgan Stanley, etc.

The strategic need for a CDO like role to manage data assets is becoming more and more accepted.

In summary, the strategic need to actively manage data to be successful in future business is becoming more and more accepted. Accordingly many firms have bundled this accountability within a special role, the Chief Data Officer.

CDOs Recent History

The role of the CDO started appearing around 2002 but did not really take off at that time. There were headlines about appointments at a few large companies, like Capital One and Yahoo, but then the job postings went down. Since 2014 the job title appears more often, but this time it seems to be a real trend.

A Gartner study of large global enterprises from that time indicated that the number of CDOs doubled between 2012 and 2013. Many of them come from large enterprises or government agencies, including Samsung, Wells Fargo, the City of Philadelphia, AIG and HSBC. (IT World, 2014)

The Gartner Study also suggested at the time that by 2015, 25% of the large global enterprises will have appointed a CDO. (Gartner, 2014).

The average time since initial implementation of the CDO role in companies is about ~3 years

I would estimate this number for 2017 to be more around 50% and in fact according to to NewVantage Partners 2016 Big Data executive survey, 54% of firms surveyed now report having appointed a Chief Data Officer, up from just 12% in 2012. Researching on LinkedIn for the CDO title returns 555 people who mention chief data officer in their profiles. That is not a lot, but it is fair to presume, that 5 years ago the number of hits would have been much lower. In fact I expect this data to be verifiable within short time as the Gartner 2017 study on CDOs is due to be published soon.

In 2016, 62.5% of firms reported that they now have at least one Big Data initiative that has been implemented; nearly double the 31.4% of firms who reported the same result in 2013. As firms comes to recognize the central role that data can play in their success, a growing number of companies are investing in efforts to forge a data culture, enabled by data-driven decision making – where a CDO can be of enormous help. (Forbes, 2016)

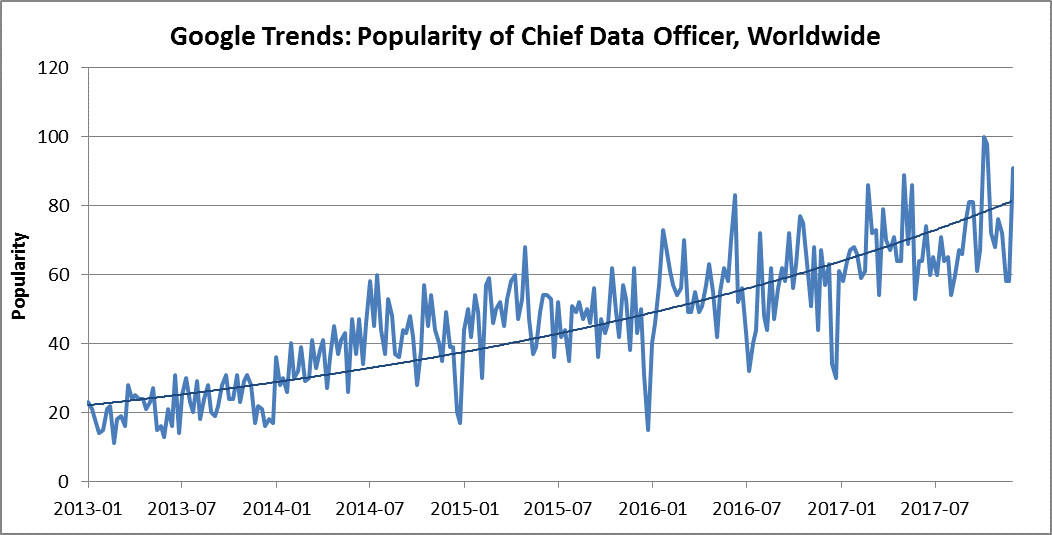

(Figure 1: Popularity of the search term Chief Data Officer. Source: Google Trends, 2018, exponential trendline)

Further, looking at Figure 1 the Google Trends analysis for the popularity of the search term Chief Data Officer again supports this statement of CDOs becoming more and more known.

Acceptance is also underlined by increased spending for a the Chief Data Office. According to a research I have found, companies invest a higher single digit millions USD budget per annum for this function nowadays.

The role gets more and more established … and funded. No enterprise would fund something in which it perceives no value. So let’s look at the value drivers and main areas of responsibility of the CDO in the next part before we go into the outlook in the final part 3.

Writer: Norman Stuertz, Chief Data Officer, Credit Suisse